Energy efficiency ratings are essential tools for investors and lenders, offering critical insights into environmental performance. These ratings influence decisions in commercial and residential real estate, attracting premium rents and higher market prices for energy-efficient properties. Global regulatory bodies integrate these ratings into lending frameworks, encouraging sustainability. By leveraging comparison tools and data transparency, investors can make strategic decisions, mitigate risks, maximize returns, and support environmentally conscious projects, contributing to long-term economic stability. Effective use of energy efficiency ratings is crucial for competitive advantage in the growing sustainable investment market.

In the pursuit of sustainable and profitable investments, understanding the interplay between energy efficiency ratings and investor costs is paramount. As global efforts to combat climate change intensify, lenders and investors are increasingly factoring in energy efficiency as a key performance indicator. This article delves into the intricate relationship between these factors, exploring how thorough assessments of energy efficiency can drive cost savings for investors while enhancing lending decisions. By leveraging lending factors effectively, investors can navigate the market with greater insight, contributing to both financial returns and environmental sustainability.

Understanding Energy Efficiency Ratings: Impact on Investor Costs

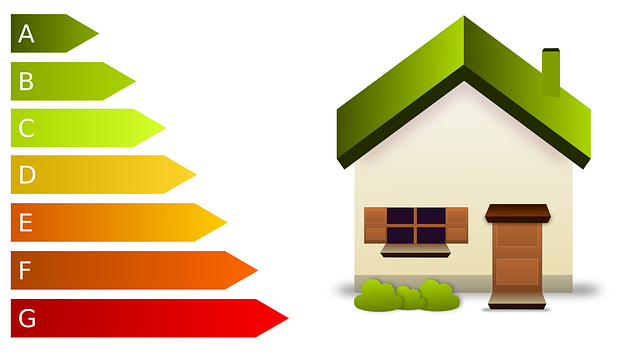

Energy efficiency ratings play a pivotal role in shaping investor costs across various lending sectors. These ratings serve as a critical metric for assessing the energy performance of buildings, appliances, or even entire cities. By comparing energy efficiency ratings, investors can make informed decisions that balance environmental sustainability with financial returns. A comprehensive understanding of these ratings allows investors to identify opportunities where efficient energy use translates directly into cost savings and improved asset value.

For instance, a detailed analysis of commercial real estate reveals that buildings with higher energy efficiency ratings tend to attract tenants willing to pay premium rents. This is driven by the reduced operational costs associated with energy-efficient structures. Similarly, residential properties equipped with energy-saving appliances and systems can command higher prices in the market. Investors who leverage these insights through advanced lending factors can mitigate risks and maximize returns. Energy efficiency rating comparison tools become essential for benchmarking performance across different investment portfolios, enabling strategic decisions that contribute to a more sustainable financial landscape.

Furthermore, regulatory bodies worldwide are increasingly incorporating energy efficiency ratings into their lending frameworks. This shift encourages investors to prioritize projects that align with green initiatives, fostering a market-driven approach to sustainability. As data on energy consumption becomes more accessible and transparent, investors have the opportunity to integrate these insights into their risk assessment models. By embracing this trend, lenders can not only support environmentally conscious endeavors but also contribute to long-term economic stability by promoting efficient resource utilization.

Lending Factors: Unlocking Efficient Investment Opportunities

In today’s sustainable investment landscape, energy efficiency ratings have emerged as a crucial lending factor, significantly impacting investors’ costs and market strategies. These ratings serve as a powerful tool to assess and compare the environmental performance of various assets, enabling investors to make informed decisions. When evaluating potential investments, a thorough analysis of energy efficiency ratings can unlock efficient opportunities while mitigating financial risks.

Lending factors, such as energy efficiency, play a pivotal role in shaping the financial viability of investment portfolios. For instance, consider two similar properties with identical market values. The one boasting superior energy efficiency ratings can command lower borrowing costs due to its reduced operational expenses and lower environmental impact. This rating difference may translate into significant savings for investors over time, making it an attractive factor for lenders and a key consideration for borrowers. Energy efficiency ratings comparison between assets allows investors to identify not only the most cost-effective choices but also those that align with sustainable investment goals.

Expert analysts emphasize that incorporating energy efficiency ratings into lending factors analysis can foster responsible investing practices. By promoting investments in energy-efficient projects, lenders contribute to a greener economy while ensuring long-term financial stability. For investors, this shift presents an opportunity to enhance portfolio performance and appeal to environmentally conscious stakeholders. As the demand for sustainable investments grows, understanding and utilizing energy efficiency ratings effectively will become indispensable for staying competitive in the market.

Assessing Energy Efficiency's Influence on Market Trends

Energy efficiency ratings have emerged as a pivotal factor shaping market trends for investors, particularly in the lending sector. As global efforts to combat climate change intensify, these ratings offer a compelling lens through which to assess and compare potential investments. By evaluating the energy efficiency of buildings or assets, lenders can make informed decisions that balance financial returns with environmental sustainability.

A meticulous analysis of energy efficiency ratings reveals substantial insights into market dynamics. For instance, a comparative study of commercial properties in major urban centers may unveil significant disparities in energy consumption and associated costs. Buildings boasting superior energy efficiency ratings not only attract lower lending rates but also exhibit enhanced long-term financial performance. This dynamic underscores the synergy between energy conservation and economic viability. Moreover, investors are increasingly incorporating these ratings into their risk assessment frameworks, recognizing that environmentally responsible investments can mitigate potential liabilities and unlock new opportunities.

The integration of energy efficiency ratings into lending practices is a strategic move that reflects evolving market sentiments. Lenders who embrace this approach not only contribute to a greener economy but also position themselves as industry leaders. By incentivizing energy-efficient investments, they foster a competitive environment where sustainability becomes a core driver of market trends. This shift in perspective is underscored by recent data indicating a correlation between higher energy efficiency ratings and increased property values, highlighting the positive impact on both lenders and borrowers.

Effective Strategies for Mitigating Risks Through Ratings Analysis

Energy efficiency ratings play a pivotal role in shaping investors’ decisions and managing risks in lending. By analyzing these ratings, lenders can mitigate potential costs associated with energy-inefficient investments. Effective strategies involve a comprehensive comparison of energy efficiency across various projects or properties. This approach allows for informed risk assessment, enabling investors to make sound choices. For instance, a detailed study of commercial buildings’ energy performance revealed that those with higher efficiency ratings consistently demonstrated lower operational costs over time, making them more attractive to lenders and investors.

One powerful method is benchmarking against industry standards. Investors can assess the relative energy efficiency of different assets by comparing their ratings. This benchmark data provides a clear understanding of the potential financial savings or risks associated with specific investments. For example, when evaluating a portfolio of residential properties, a side-by-side analysis of energy efficiency ratings could highlight the most efficient homes, which may offer better long-term return prospects. Such strategic comparisons facilitate informed lending decisions, fostering a more sustainable and financially prudent investment environment.

Moreover, energy efficiency ratings comparison tools can be leveraged to identify outliers and areas for improvement. Lenders and investors can set specific criteria based on historical data and industry trends, allowing them to pinpoint projects with exceptional or concerning energy performance. This proactive approach enables targeted interventions and risk mitigation strategies. As the cost of energy continues to rise, maintaining and improving energy efficiency becomes increasingly critical. Investors who integrate these ratings analyses into their lending practices will be better equipped to navigate a dynamic market, ensuring both financial stability and environmental sustainability.