Energy Efficiency Ratings: Critical for modern borrowing strategies, offering numerical assessments of energy consumption. Borrowers use them to compare products, invest in upgrades during renovations, reduce utility costs, and access government incentives. In an era of rising energy costs, these ratings guide strategic financial decisions with long-term cost savings and environmental benefits. Trends include smart building systems, renewable energy integration, and prioritizing long-term benefits. Lenders increasingly incorporate energy efficiency ratings into borrowing criteria, promoting sustainability and offering competitive loan terms. Digitalization enables comprehensive comparisons and personalized recommendations for eco-friendly options.

In today’s energy-conscious world, understanding the impact of energy efficiency ratings on borrowing strategies is paramount for both lenders and borrowers. As global efforts to combat climate change intensify, these ratings have emerged as a crucial indicator of sustainable practices, influencing financial decisions significantly. The current trend reveals that energy-efficient properties are increasingly sought after by borrowers, who seek not only cost savings but also long-term investment value. This article delves into the intricate relationship between energy efficiency ratings and borrowing strategies, providing insights that can empower lenders to offer tailored solutions while guiding borrowers towards making informed financial choices.

Understanding Energy Efficiency Ratings: Basics Explained

Energy efficiency ratings have become a pivotal aspect of borrowing strategies today, offering borrowers an insightful lens to navigate the financial landscape. These ratings serve as a comprehensive measure of how effectively a product or system utilizes energy, providing valuable data for consumers and lenders alike. Understanding this basic concept is essential for making informed decisions in the current market trends where energy conservation is at the forefront.

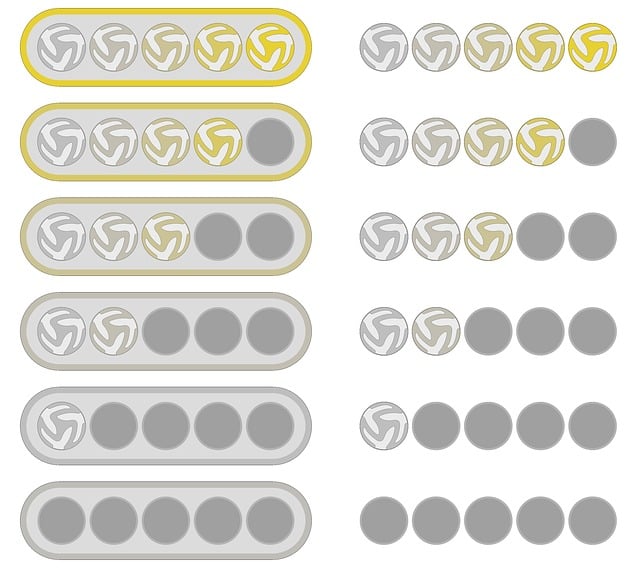

At its core, an energy efficiency rating compares the performance of various products by assigning them numerical values based on their power consumption. For instance, appliances like refrigerators or air conditioners are evaluated against set standards to determine how much energy they consume over a specific period. This simple yet powerful tool allows consumers to quickly assess and compare different options, fostering a more sustainable approach to borrowing. Lenders, too, have embraced this concept, incorporating these ratings into their assessment criteria, thereby influencing borrowers’ choices and financial planning.

By analysing current trends, borrowers can strategically align their energy-efficient purchases with financing plans. For example, when considering a home renovation loan, investing in energy-efficient appliances or insulation can be a game-changer. Not only do these upgrades enhance the property’s value, but they also reduce ongoing utility costs, making monthly repayments more manageable. This strategic approach, guided by an understanding of energy efficiency ratings comparison, ensures that borrowing is not just about securing funds but also about long-term savings and environmental responsibility. Moreover, with access to government incentives and grants for energy-efficient initiatives, borrowers can further optimize their financial plans, creating a sustainable future while managing debt effectively.

Impact on Borrowers: Strategies for Energy Savings

In today’s world, where energy costs continue to rise, understanding energy efficiency ratings has become paramount for borrowers looking to optimize their financial strategies. These ratings serve as a compass, guiding individuals and businesses toward making informed decisions regarding energy consumption and savings. The impact of energy efficiency ratings on borrowers’ strategies is profound, fostering not only cost savings but also contributing to environmental sustainability.

For borrowers, comparing energy efficiency ratings across different options is a crucial step in crafting a strategic plan for energy savings. For instance, when considering home loans, an individual might choose between a standard mortgage and one that incentivizes energy-efficient appliances and insulation. A thorough analysis of these ratings can reveal significant long-term benefits. According to recent studies, homes with superior energy efficiency ratings experience average utility bill reductions of 25% compared to their less efficient counterparts. This translates into not only financial savings but also a more predictable and manageable cash flow for borrowers.

Experts suggest that borrowers take an active approach in this process. One practical step is to request and scrutinize the Energy Star certification, which compares energy performance across products and buildings. By doing so, borrowers can make apples-to-apples comparisons when evaluating loans or purchasing energy-efficient goods. Additionally, staying informed about local and federal incentives for energy efficiency can further enhance savings potential. For example, many governments offer tax credits and rebates for installing solar panels or upgrading to smart thermostats, providing borrowers with additional tools in their energy-saving arsenal.

Current Trends: Technologies Enhancing Efficiency

In today’s energy-conscious landscape, borrowers are increasingly strategic about their investments, particularly when it comes to buildings and infrastructure. One critical factor shaping this strategy is the integration of advanced technologies that enhance energy efficiency. Current trends in this domain offer profound insights into how borrowers can optimize their choices, leading to substantial long-term savings and environmental benefits.

Technological innovations have significantly evolved the way we assess and improve energy efficiency. Smart building systems, for instance, are revolutionizing the management of lighting, heating, and cooling systems, allowing for real-time monitoring and adjustments. These technologies enable borrowers to make informed decisions by providing detailed data on energy consumption patterns, facilitating precise comparisons between different properties. An energy efficiency ratings comparison becomes a powerful tool, as it reveals the potential for significant energy savings through technological interventions. For example, a study by the U.S. Department of Energy found that smart thermostats can reduce heating and cooling costs by up to 15%, underscoring their value in enhancing energy efficiency ratings.

Moreover, renewable energy integration is at the forefront of these advancements. Solar panels, wind turbines, and geothermal systems are being seamlessly incorporated into building designs, providing borrowers with sustainable options that offer both environmental and economic advantages. These technologies not only reduce reliance on traditional energy sources but also contribute to a more robust energy efficiency ratings comparison. As governments worldwide implement policies encouraging renewable energy adoption, borrowers are increasingly leveraging these incentives to create green buildings that command higher energy efficiency ratings. For instance, properties featuring solar panels often attract premium pricing due to their reduced operational costs and positive environmental impact, making them highly desirable on the market.

Expert advice suggests that borrowers should prioritize investments in technologies that offer both immediate and long-term benefits. This includes not only high-efficiency appliances and systems but also the infrastructure to support renewable energy sources. By embracing these trends, borrowers can navigate the market with a strategic edge, ensuring their portfolio comprises assets with superior energy efficiency ratings. Ultimately, this approach not only translates into substantial cost savings but also aligns with global sustainability goals, making it a wise and responsible investment strategy.

Lenders' Perspective: Evaluating Borrowing Criteria

Lenders play a pivotal role in shaping the borrowing landscape, and their evaluation criteria are increasingly influenced by energy efficiency ratings as sustainability becomes a core concern. In today’s market, lenders are not merely assessing traditional creditworthiness but also factoring in a borrower’s commitment to energy conservation and environmental responsibility. This shift is driven by both regulatory pressures and market trends, with consumers and businesses alike seeking more eco-friendly financing options.

When evaluating borrowing criteria from a lender’s perspective, energy efficiency ratings offer a comprehensive view of a borrower’s potential. Lenders can now compare energy performance across different entities, enabling them to make informed decisions. For instance, a bank may consider two similarly structured properties; one with state-of-the-art insulation and efficient appliances, bearing a higher energy efficiency rating, against another that lacks such modernizations. The property with superior ratings not only indicates lower operational costs but also demonstrates a responsible approach to resource management, making it an attractive investment choice. This comparison allows lenders to assess the long-term financial viability and sustainability of the borrowings.

Furthermore, energy efficiency ratings provide lenders with valuable data for risk assessment. Efficient buildings tend to have more predictable utility expenses, reducing the likelihood of unexpected financial burdens on borrowers. Lenders can use this information to structure loans with competitive rates and flexible terms, fostering a positive relationship between financing institutions and environmentally conscious entities. As the market continues to evolve, lenders are expected to incorporate energy efficiency ratings even more rigorously, encouraging broader adoption of sustainable practices among borrowers.

Future of Energy-Efficient Lending Practices

In today’s sustainable lending landscape, energy efficiency ratings have emerged as a pivotal tool for borrowers seeking strategic financial decisions. As the world grapples with climate change, lenders are increasingly incorporating these ratings into their evaluation processes, fostering a more environmentally conscious borrowing culture. The future of energy-efficient lending practices promises to be transformative, with borrower strategies becoming increasingly data-driven and outcome-oriented.

The trend towards digitalisation and advanced data analytics has enabled comprehensive comparisons of energy efficiency ratings across various assets and industries. Borrowers can now access detailed insights into the energy performance of properties or equipment they intend to finance, allowing for more informed choices. For instance, a commercial real estate borrower planning a green renovation might compare energy efficiency ratings of different building materials and technologies before committing to a loan. This comparative analysis not only ensures cost-effectiveness but also aligns with long-term sustainability goals.

Looking ahead, artificial intelligence and machine learning are set to play a pivotal role in refining energy efficiency rating systems. These technologies can process vast datasets, identify patterns, and predict energy consumption trends with remarkable accuracy. Borrowers will benefit from personalised recommendations and tailored financial products based on their specific energy efficiency profiles. Lenders, too, can mitigate risks by identifying potential areas of improvement and encouraging borrowers to adopt more efficient practices. This evolution in lending practices will drive a circular economy, where resources are optimised, and environmental impact is minimised.