Energy efficiency ratings are transformative for borrowers and lenders, offering strategic insights into property investments. These ratings indicate energy performance, guiding decisions with annual utility savings up to 30%. Standardized systems like ENERGY STAR facilitate comparisons, attracting cost-conscious borrowers and lenders. By prioritizing these ratings, borrowers save money, contribute to sustainability, and secure favorable financing terms. Lenders offer incentives for energy efficiency, integrating ratings into risk models for precise pricing. This trend benefits borrowers through competitive loan terms and fosters a greener future.

In the realm of borrowing and lending, understanding energy efficiency ratings has emerged as a strategic imperative. As global financial institutions navigate an increasingly sustainable landscape, these ratings play a pivotal role in shaping borrowers’ strategies. The challenge lies in comprehending how financial factors intertwine with environmental metrics, particularly energy efficiency. This article delves into this intricate relationship, elucidating the impact of energy efficiency ratings on borrower strategies. By demystifying these connections, we empower financiers to make informed decisions, fostering a more sustainable and prosperous future.

Understanding Energy Efficiency Ratings: A Financial Lens

Energy efficiency ratings play a pivotal role in shaping borrowers’ strategies by offering a financial lens through which to evaluate and compare potential investments. These ratings are critical indicators of a property’s or asset’s energy performance, enabling borrowers to make informed decisions about their financing choices. When assessing a loan application, lenders often scrutinize the energy efficiency ratings of a borrower’s intended purchase, be it a residential or commercial property. This practice is driven by the growing awareness that energy-efficient investments not only benefit the environment but also offer substantial financial advantages in the long term.

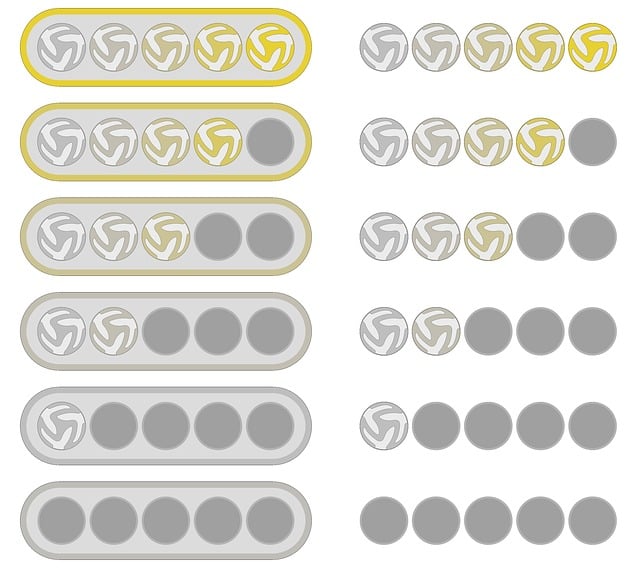

A comprehensive energy efficiency rating comparison reveals disparities in energy consumption and potential savings across various properties. For instance, according to recent studies, buildings with higher energy efficiency ratings can reduce utility bills by 20-30% annually compared to their less efficient counterparts. Such savings are particularly appealing to borrowers seeking sustainable and cost-effective investment options. Lenders, too, recognize this value, often offering competitive interest rates and favorable loan terms to borrowers who opt for energy-efficient properties. This trend is not only environmentally beneficial but also creates a financial incentive structure that encourages responsible borrowing and spending habits.

Borrowers can leverage the availability of standardized energy efficiency rating systems, such as ENERGY STAR or similar regional certifications, to their advantage. These ratings provide an objective measure of a property’s energy performance, enabling borrowers to compare different options effectively. By understanding the energy efficiency landscape, borrowers can strategically position themselves in the market, securing financing for investments that not only meet but exceed industry standards for energy conservation. This proactive approach ensures borrowers stay ahead of the curve in terms of both financial savings and environmental impact.

Impact on Borrowing Decisions: Key Considerations

Energy efficiency ratings play a pivotal role in shaping borrowers’ strategies by influencing key decisions related to financing and investment. In today’s market, lenders and investors are increasingly incorporating energy efficiency data into their assessment of prospective borrowing entities, be it individuals seeking home loans or businesses aiming for commercial financing. This shift is driven by the global push towards sustainability and the recognition of energy efficiency as a critical factor in long-term financial viability.

When borrowers consider an investment, especially in real estate, they are often prompted to compare energy efficiency ratings across different properties. For instance, a prospective homeowner might scrutinize the Energy Star rating of potential houses to gauge their future utility expenses. Similarly, businesses evaluating office spaces may delve into comprehensive energy audits and comparisons, ensuring that the facility aligns with their sustainability goals and budget constraints. This energy efficiency ratings comparison allows borrowers to make informed choices, anticipating not only immediate financial returns but also long-term savings on energy costs.

The impact extends beyond individual decisions; it influences market trends and investment strategies at large. Lenders, armed with detailed energy performance data, can offer tailored financing options, including incentives for energy-efficient projects. For instance, reduced interest rates or extended repayment periods may be provided to borrowers who invest in renewable energy systems or implement advanced insulation technologies. This not only benefits individual borrowers but also contributes to a broader shift towards more sustainable practices in the borrowing sector. By embracing energy efficiency ratings as a central consideration, borrowers can navigate financial landscapes with enhanced confidence, securing not just favorable terms but also contributing to a greener future.

Analyzing Cost Savings: Short-Term vs Long-Term

Energy efficiency ratings play a pivotal role in shaping borrowers’ strategies by offering a clear view of potential cost savings. When analyzing energy efficiency, a crucial distinction lies between short-term and long-term financial implications. Borrowers often focus on immediate returns, but a deeper dive into energy efficiency ratings comparison reveals substantial gains over time. For instance, retrofitting an old building with energy-efficient appliances and systems might incur higher upfront costs. However, this investment can significantly reduce utility bills, leading to quicker payback periods and long-term financial stability.

A comprehensive energy efficiency ratings analysis allows borrowers to weigh the trade-offs between short-term outlay and future savings. This is particularly relevant in commercial real estate where tenants are increasingly conscious of environmental factors. Landlords who invest in energy-efficient properties can attract eco-conscious businesses, ensuring long-term occupancy and higher rental yields. Moreover, government incentives for energy efficiency often provide additional financial leverage, further enhancing the viability of these projects.

In many cases, a robust energy efficiency ratings comparison demonstrates that while initial costs may be higher, the reduced energy consumption translates to substantial savings over 5-10 years. This long-term perspective is essential for borrowers aiming for sustainable financial growth. By embracing energy efficiency, borrowers can mitigate risks associated with fluctuating energy prices and position themselves as forward-thinking, responsible investors.

Sustainable Strategies: Energy Efficiency in Lending

Energy efficiency ratings play a pivotal role in shaping borrowers’ strategies within sustainable financial practices. As lenders and investors increasingly consider environmental factors, understanding energy efficiency ratings becomes crucial for both parties. These ratings provide a standardized measure of a property’s energy performance, enabling informed lending decisions. By comparing energy efficiency across various assets, lenders can identify lower-risk investments with potential long-term cost savings for borrowers.

For instance, an energy efficiency rating comparison between two similar properties may reveal a 20% difference in energy consumption. This data empowers lenders to offer more competitive terms and rates to energy-efficient borrowers, incentivizing sustainable practices. Conversely, less efficient properties might require higher interest rates or specific conditions to mitigate risks associated with higher energy costs. Borrowers can benefit from these insights by strategically targeting investments that align with their financial goals while reducing environmental impact.

Experts suggest that lenders integrate energy efficiency ratings into risk assessment models, similar to credit scoring. This integration allows for more precise pricing and tailored products. For instance, a leading bank in the UK has introduced a Green Mortgage program, offering reduced rates to homeowners who improve their property’s energy efficiency. Such initiatives not only promote sustainable strategies but also foster market competition, driving down costs across the board. By embracing energy efficiency ratings as a key factor, borrowers can access more favorable lending terms while contributing to a greener future.