Energy efficiency ratings are crucial for investors assessing lending options, offering insights into cost savings and environmental benefits. These ratings standardize evaluation of energy performance across buildings, guiding informed decisions with potential for long-term profitability. Strategies include comparing ratings, deep data analysis, regulatory awareness, and leveraging standardized metrics like Energy Star for strategic planning. Real-world examples show significant savings from efficient properties and retrofitting programs, positioning energy efficiency ratings as powerful tools for risk mitigation and financial growth in sustainable investments.

In the rapidly evolving landscape of sustainable investing, understanding the interplay between energy efficiency ratings and investor costs is paramount. As the global shift towards renewable energy intensifies, lenders and investors alike are increasingly scrutinizing the energy performance of assets. Energy efficiency ratings have emerged as a critical tool, enabling informed decision-making and strategic lending practices. This article delves into the intricate relationship between these ratings and their profound impact on investor costs, offering valuable insights for navigating this evolving market with precision and expertise.

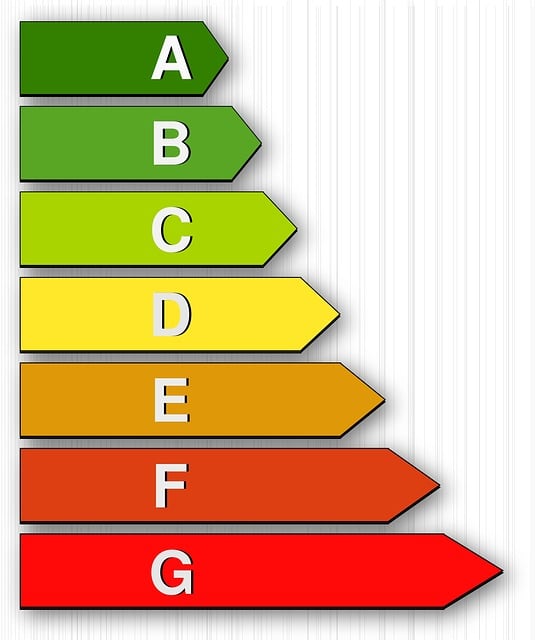

Understanding Energy Efficiency Ratings: The Basics

Energy efficiency ratings have become a crucial factor for investors considering lending options, as they directly impact costs and long-term profitability. Understanding these ratings is essential in making informed decisions within the financial landscape. At their core, energy efficiency ratings assess and compare the energy performance of various products, systems, or buildings. This simple yet powerful tool allows investors to gauge the potential savings and environmental benefits associated with specific lending recipients.

A key aspect to grasp is that these ratings provide a standardized metric for evaluating energy consumption. For instance, when comparing two similar appliances, an investor can easily identify which one offers superior energy efficiency based on its rating. This comparison becomes invaluable when deciding between multiple investment opportunities, especially in the context of renewable energy projects or energy-efficient retrofits. According to recent studies, investments in energy-efficient technologies have shown a significant positive correlation with reduced operational costs for borrowers, making them attractive prospects for lenders.

The process involves examining factors such as design, materials, and operational protocols that contribute to energy usage. For example, an energy-efficient building might feature advanced insulation, smart thermostats, and energy-saving lighting systems, all of which are reflected in its rating. By analyzing these ratings, investors can anticipate potential savings and assess the overall viability of a project. This proactive approach not only minimizes financial risks but also aligns investment strategies with global sustainability goals.

Impact on Investor Costs: A Comprehensive Analysis

Energy efficiency ratings have a profound impact on investor costs across various sectors, particularly in the lending landscape. These ratings serve as a critical tool for assessing the financial viability of energy-related projects and investments. When comparing potential ventures, investors often turn to energy efficiency ratings as a key indicator of long-term cost savings and risk mitigation. For instance, a comprehensive study analyzing commercial real estate loans revealed that properties with higher energy efficiency ratings commanded lower borrowing costs due to their reduced operational expenses. This trend underscores the direct correlation between energy efficiency and investor appeal.

The process of incorporating energy efficiency ratings into lending factors involves a nuanced approach. Lenders must not only consider the initial investment in energy-efficient technologies but also project potential savings over time. For renewable energy projects, such as solar panel installations or wind turbines, lenders can assess the historical performance of similar projects to estimate future revenue streams and cost recoveries. This data-driven approach enables more accurate risk assessments, leading to competitive lending terms for energy-efficient initiatives. For instance, a comparison of energy efficiency ratings across various manufacturing facilities showed that those with advanced energy management systems secured loans at significantly lower interest rates compared to less efficient counterparts.

Moreover, the long-term financial benefits of energy efficiency ratings cannot be overlooked. Energy-efficient buildings, for example, often experience reduced utility bills, leading to faster paybacks on initial investment. This stability attracts investors seeking stable, income-generating assets. As governments worldwide implement policies encouraging energy conservation, investments in energy-efficient technologies become increasingly attractive. Investors can leverage these trends by actively incorporating energy efficiency ratings into their lending decisions, fostering a more sustainable and profitable investment ecosystem. By embracing energy efficiency as a core lending factor, financial institutions can drive widespread adoption of eco-friendly practices while mitigating risks and unlocking new avenues for growth.

Lending Factors: Unlocking Financial Opportunities

Energy efficiency ratings play a pivotal role in shaping investors’ decisions, especially when coupled with strategic lending factors. These ratings serve as a compass, guiding investors towards cost-effective and sustainable opportunities. By meticulously comparing energy efficiency ratings across various projects or properties, lenders and investors can unlock significant financial advantages. For instance, a comprehensive analysis of commercial buildings reveals that those with higher energy efficiency ratings often experience reduced operational costs, attracting investors seeking long-term, profitable ventures.

Lending factors, when aligned with energy efficiency ratings, become powerful tools for risk assessment and return on investment (ROI) prediction. Lenders can leverage data on energy consumption patterns and historical rating comparisons to offer tailored financing terms. This approach allows investors to access capital at competitive rates, particularly for projects prioritizing green initiatives. For instance, a bank might offer lower interest rates to developers investing in renewable energy systems, fostering a favorable environment for both lenders and investors.

Practical application involves delving into detailed energy audits and rating reports before extending loans or investments. These assessments provide insights into potential cost savings and environmental benefits associated with specific projects. Investors can then make informed decisions, considering not only financial returns but also the broader impact of their investments on energy conservation. This strategic approach not only mitigates risks but also positions investors as responsible stakeholders in the transition towards a more sustainable future.

Navigating Energy-Efficient Investments: Strategies for Success

Navigating Energy-Efficient Investments: Strategies for Success

Energy efficiency ratings have emerged as a powerful tool in the investment landscape, offering both opportunities and challenges for investors. As the global push towards sustainability intensifies, understanding how these ratings impact costs is crucial. By factoring in energy efficiency, lenders can mitigate risks and attract environmentally conscious investors, while also facilitating access to capital for energy-efficient projects. One key strategy involves comparing energy efficiency ratings across different investment options. This allows for a nuanced approach, identifying not just the most efficient but also those offering the best value. For instance, a detailed energy efficiency ratings comparison of similar properties can reveal significant differences in operational costs, with higher-rated buildings often commanding premium rental prices or selling at a premium.

Implementing effective lending factors requires a deep dive into the underlying data. Investors and lenders must consider not only the current energy performance but also the potential for improvement. A thorough assessment includes evaluating the property’s age, insulation, heating/cooling systems, and lighting efficiency—all factors that contribute to overall energy consumption. By benchmarking these against established energy efficiency standards, such as LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method), lenders can set realistic expectations and risk parameters. This data-driven approach not only ensures responsible lending but also encourages borrowers to adopt more sustainable practices to enhance their investment’s long-term viability.

Moreover, staying abreast of evolving energy efficiency regulations is vital for strategic decision-making. Government incentives and grants often target energy-efficient investments, creating favorable conditions for early adopters. For instance, tax credits for installing solar panels or implementing smart building technologies can significantly reduce initial investment costs. By aligning with these regulatory trends, investors position themselves not only to benefit from financial savings but also to contribute to a greener future. This forward-thinking approach not only ensures cost-effectiveness but also fosters public trust and supports the broader transition towards sustainable practices in the investment sector.

Case Studies: Real-World Examples of Cost Savings

Energy efficiency ratings have emerged as a powerful tool for investors looking to mitigate costs and enhance the financial performance of their portfolio. Real-world examples highlight significant cost savings achieved through leveraging these ratings effectively. For instance, a 2022 study by the U.S. Department of Energy revealed that properties with higher energy efficiency ratings commanded premium prices and experienced lower vacancy rates compared to their less efficient counterparts. This case study illustrates how investors can leverage energy efficiency as a strategic tool for both value creation and risk mitigation.

In another notable example, a large institutional investor implemented an energy-efficient retrofitting program across its commercial real estate portfolio. By comparing energy performance using standardized metrics like Energy Star ratings, the investor identified opportunities to upgrade older buildings with more efficient systems. This initiative resulted in substantial utility cost savings—averaging 20% across all retrofitted properties within the first year. Furthermore, the improved operational efficiency enhanced tenant satisfaction and occupancy rates, demonstrating a holistic benefit from aligning energy efficiency ratings with investment strategies.

An energy efficiency ratings comparison between similar properties becomes crucial in making informed decisions. Investors can employ data analytics to benchmark buildings against industry standards, identifying areas for improvement and potential returns on investment. For example, a comparison of HVAC systems in different office spaces might reveal that upgrading to more efficient models could reduce energy consumption by 15-20%. Such insights enable strategic planning and budget allocation for cost-effective upgrades, ensuring investors maximize the financial benefits associated with energy efficiency.