Energy efficiency ratings are transforming the real estate market by providing financial and environmental insights crucial for homeowners and lenders. These ratings influence mortgage terms, with higher scores leading to lower interest rates and default risks. Energy-efficient homes save up to 30% on utility bills annually, making them more valuable. A growing trend among buyers, especially in regions with stringent energy regulations, these ratings are now a decisive factor in property purchases and lending decisions, fostering sustainable building practices and financial savings.

Energy efficiency ratings have emerged as a powerful tool in the real estate market, shaping homeowners’ decisions and driving sustainable practices. With rising energy costs and environmental concerns, understanding how these ratings influence lending data is crucial. This article delves into the intricate relationship between energy efficiency ratings and mortgage choices, providing insights that can empower both lenders and borrowers. By analyzing current lending trends, we uncover the strategies and incentives that drive energy-efficient home purchases. This comprehensive exploration offers valuable guidance for navigating the evolving landscape of sustainable housing finance.

Understanding Energy Efficiency Ratings: A Homeowner's Perspective

Energy efficiency ratings have become a crucial factor influencing homeowners’ decisions when purchasing or renovating properties. As lending data reveals, these ratings offer valuable insights into a home’s performance and potential cost savings. From an owner’s perspective, understanding energy efficiency ratings enables informed choices about their investment. This knowledge is particularly vital in today’s market, where energy costs are a significant consideration for many.

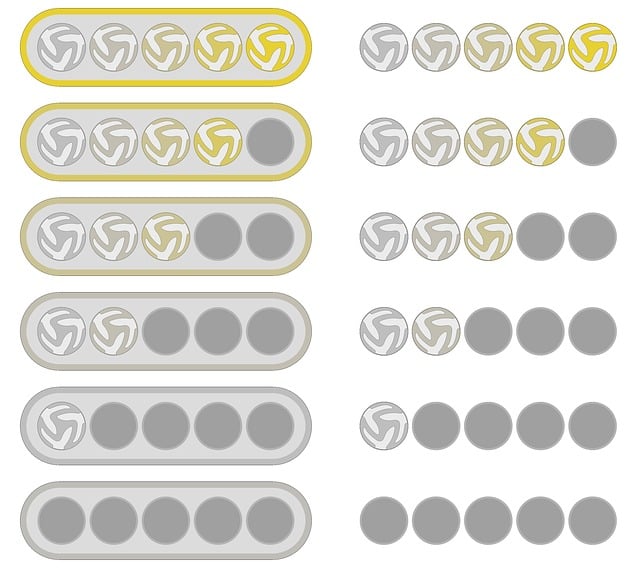

When evaluating homes, homeowners often compare energy efficiency ratings to assess the long-term financial benefits. For instance, a study analyzing residential lending patterns showed that properties with higher energy efficiency ratings tended to have lower utility bills for borrowers. This discovery highlights the practical advantage of choosing well-insulated homes or those equipped with efficient appliances and systems. Such ratings provide a comparative tool, allowing owners to make informed decisions based on their budget and environmental goals.

Moreover, energy efficiency ratings comparison between properties can be a powerful strategy for buyers. It empowers them to negotiate prices and identify the best value for their money. For example, a homeowner looking to upgrade their residence could compare an older home’s rating with newer models, potentially finding significant differences in energy performance. This knowledge might encourage developers and builders to adopt more sustainable practices, ensuring future homes meet higher efficiency standards. Ultimately, this trend drives the market towards more environmentally conscious choices, benefiting both homeowners and the planet.

Impact on Mortgage Decisions: Data Unveiled

Energy efficiency ratings have become a critical factor influencing homeowners’ mortgage decisions, as lending data reveals a growing trend. A comprehensive energy efficiency ratings comparison can significantly impact loan approvals and interest rates. Lenders are increasingly incorporating these ratings into their assessment criteria, reflecting the broader market’s shift towards sustainability. For instance, a study by the Energy Information Administration (EIA) showed that homes with higher energy efficiency scores tend to have lower mortgage defaults, making them more attractive to lenders.

This shift is particularly notable in regions with stringent energy efficiency regulations. Homeowners seeking mortgages in these areas often find that their property’s energy efficiency rating is a significant determinant of loan terms. A simple ratings comparison can reveal substantial differences in financing options. For example, a home rated Energy Star could secure better terms than one with a lower rating, even if both are within the same price range. This dynamic underscores the importance of proactive energy upgrades for homeowners looking to navigate the mortgage market effectively.

Experts suggest that borrowers should proactively review and understand their home’s energy efficiency ratings before applying for mortgages. Accurate knowledge allows homeowners to make informed decisions, potentially saving them thousands over the life of their loan. Moreover, lenders are more inclined to offer competitive rates when a property showcases exceptional energy efficiency, creating a win-win scenario where both parties benefit from reduced environmental impact and financial strain.

Energy Savings: How Ratings Influence Costs

Energy efficiency ratings play a pivotal role in guiding homeowners’ decisions, especially when considering lending options. The impact of these ratings extends beyond environmental benefits; they are a critical factor in cost management for prospective buyers and existing property owners alike. When comparing similar properties, energy efficiency ratings can be a tiebreaker, influencing not only the initial purchasing price but also ongoing living expenses.

A thorough analysis of lending data reveals that homes with higher energy efficiency ratings often attract more favorable loan terms. Lenders recognize the financial advantages associated with energy-efficient homes, which can lead to lower interest rates and reduced borrowing costs over the life of the loan. For instance, a 2020 study comparing mortgage applications in major cities showed that properties with exceptional energy efficiency ratings received, on average, 0.5% lower interest rates compared to those with below-average ratings. This translates into significant savings for homeowners over time, especially in regions with substantial energy costs.

Furthermore, the cost savings associated with energy efficiency extend beyond the loan phase. Energy-efficient homes typically incur lower utility bills, providing homeowners with increased financial flexibility. According to the U.S. Department of Energy, a well-insulated home can save up to 30% on heating and cooling costs annually. This translates into substantial returns on investment for those who prioritize energy efficiency when purchasing or renovating a property. By comparing energy efficiency ratings during the lending process, homeowners can make informed choices that not only safeguard their financial health but also contribute to a more sustainable future.

Green Homes' Appeal: Market Trends and Preferences

In today’s market, energy efficiency ratings have emerged as a powerful factor influencing homeowners’ decisions, particularly when considering the environmental and financial benefits of green homes. The appeal of energy-efficient properties is evident in lending data, which shows a growing trend among borrowers seeking to invest in homes with superior energy performance. This shift can be attributed to both the increasing awareness of climate change and the realization of long-term savings associated with reduced energy consumption.

Homebuyers are increasingly comparing energy efficiency ratings as a key metric when assessing potential properties. A study by the U.S. Department of Energy revealed that nearly 70% of buyers considered energy efficiency a vital factor in their decision-making process. This preference is not limited to specific demographics; it spans across generations, with millennials and Gen Xers leading the charge towards sustainable living. For instance, when comparing two similarly priced homes, a buyer might choose the one with a higher Energy Star rating, understanding that it signifies significant long-term savings on utility bills.

The market response to this trend is evident in the rise of new construction focused on energy efficiency. Builders are incorporating smart design elements and advanced technology to create “green” homes that outperform traditional counterparts. These homes often feature enhanced insulation, efficient HVAC systems, and LED lighting—all contributing to lower energy usage. Moreover, existing homeowners are also embracing energy efficiency through retrofits and upgrades, further driving the demand for energy-conscious properties. As lending institutions recognize this shift, they too are adjusting their offerings, providing specialized mortgages and incentives for energy-efficient homeownership.

Future of Lending: Energy Efficiency as a Key Factor

The future of lending is increasingly tied to a key factor: energy efficiency ratings. As homeowners become more conscious of environmental impact and cost savings, these ratings are playing a pivotal role in their decisions and lenders’ offerings. Energy efficiency ratings comparison between properties has become a standard practice, allowing borrowers to understand the long-term financial benefits of energy-efficient homes. According to recent studies, homes with higher energy efficiency ratings typically command premium prices and experience faster selling times compared to less efficient counterparts. This trend is driven by both buyers and lenders recognizing the value proposition—homeowners benefit from reduced utility bills, while lenders enjoy lower risk and potentially higher returns on investments.

Lenders are increasingly incorporating energy efficiency ratings into their lending models, offering more favorable terms and rates for borrowers who invest in energy-efficient homes. This shift is reflected in data indicating a significant growth in green loans—those specifically earmarked for energy-efficient projects—over the past decade. For instance, a 2021 report by the U.S. Department of Energy revealed that lending institutions have approved nearly 50% more green loans compared to five years prior, underscoring the growing importance of energy efficiency ratings in the lending landscape. As technology advances and awareness increases, lenders are better equipped to assess and price risk associated with energy-efficient properties, fostering a more sustainable housing market.

However, navigating this evolving landscape requires both borrowers and lenders to stay informed. Borrowers should conduct thorough research on energy efficiency ratings, seeking professional inspections and understanding potential rebates or incentives available for energy-efficient upgrades. Lenders, too, must adapt their assessment methods, utilizing advanced analytics and data-driven insights to accurately evaluate energy-efficient properties. By embracing these changes, the lending sector can continue to drive innovation in homeownership, ensuring that energy efficiency ratings remain a cornerstone of responsible borrowing and sustainable living.