Energy efficiency ratings are reshaping investment strategies by offering a comprehensive view of companies' environmental performance and financial implications. Investors use these ratings to identify leaders in sustainable practices, influence portfolio composition, and capture market share as industries enhance energy efficiency due to regulatory changes and consumer preferences. Key insights include cost savings, improved risk-adjusted returns, and long-term sustainability goals. Investors can leverage rating tools for benchmark comparisons, stay ahead of regulations, and secure competitive portfolios. Practical takeaways emphasize assessing power consumption, integrating ratings into due diligence, setting improvement targets, and monitoring results for successful investment strategies aligned with global sustainability efforts.

In today’s fast-paced, data-driven investment landscape, understanding the interplay between financial trends and energy efficiency ratings is a game-changer for investors. The global shift towards sustainability has catalyzed a new era where energy-efficient technologies are not just environmental necessities but also lucrative investments. This article delves into the intricate relationship between these two factors, offering valuable insights to navigate this evolving market. By exploring recent financial trends and their correlation with energy efficiency ratings, we provide investors with a strategic framework to make informed decisions in a rapidly changing economic environment.

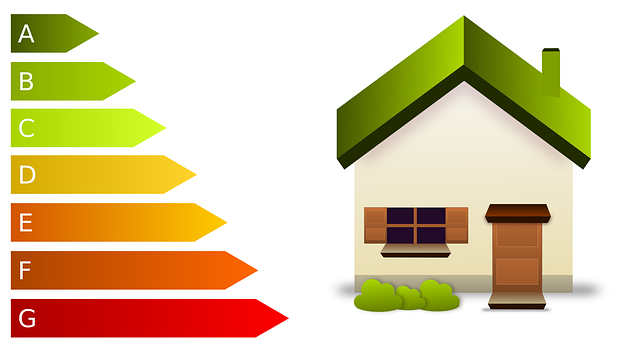

Understanding Energy Efficiency Ratings: A Key Indicator

Energy efficiency ratings have emerged as a critical factor shaping investment strategies across various sectors, particularly with the growing emphasis on sustainability and cost optimization. Investors are increasingly leveraging these ratings to make informed decisions, as they offer a comprehensive view of a company’s or product’s environmental performance and financial implications. By comparing energy efficiency ratings, investors can identify leaders in sustainable practices and those who may be lagging behind, influencing their portfolio composition and long-term growth prospects.

Understanding energy efficiency ratings involves assessing the effectiveness of energy use within systems, processes, or products. This includes evaluating power consumption, heat transfer, and overall resource utilization efficiency. A detailed analysis of these ratings allows investors to discern not only the immediate financial benefits but also the potential for future savings and market differentiation. For instance, a thorough comparison of energy efficiency ratings between similar technologies can reveal significant performance gaps, indicating areas where strategic investments could yield substantial returns while enhancing environmental sustainability.

The integration of energy efficiency ratings into investment strategies is becoming more prevalent as markets evolve to prioritize green initiatives. By adopting these ratings, investors not only align with global sustainability goals but also gain access to a wealth of data that can drive informed decision-making. Moreover, regulatory changes and consumer preferences are pushing industries to enhance their energy efficiency, creating a favorable environment for forward-thinking investors. As the demand for efficient solutions grows, companies at the forefront of this transition are poised to capture significant market share, making energy efficiency ratings a powerful tool for identifying future leaders.

Financial Markets' Response to Energy Efficiency Trends

The financial markets have been increasingly responsive to energy efficiency trends, reflecting a growing recognition of the correlation between energy conservation and long-term profitability. Energy efficiency ratings, as a key metric, play a pivotal role in guiding investors’ strategies by offering insights into a company’s operational sustainability and cost-saving potential. When comparing companies within the same sector, those with higher energy efficiency ratings often present more attractive investment opportunities.

Take for instance, the technology sector where companies like Tesla have led the charge in energy-efficient innovation. Their electric vehicles and renewable energy solutions not only represent a significant shift in consumer behavior but also offer substantial financial advantages. Investors have taken note, driving up the stock prices of such forward-thinking companies. Conversely, industries lagging in energy efficiency face rising operational costs, which can translate to lower profitability and, consequently, reduced investor appeal.

An analysis of historical data reveals that firms with robust energy management strategies have demonstrated enhanced risk-adjusted returns over the long term. This is particularly evident in industries such as manufacturing and utilities, where efficient resource utilization is not just an environmental imperative but a financial necessity. Energy efficiency ratings comparison tools allow investors to benchmark companies, facilitating informed decisions about portfolio allocation. By embracing these trends, investors can capitalize on emerging markets while mitigating risks associated with outdated practices.

As the global shift towards sustainability gains momentum, staying abreast of energy efficiency ratings is crucial for astute investors. Integrating these metrics into investment strategies not only promotes environmentally responsible practices but also ensures financial resilience in an increasingly competitive and regulated market. By prioritizing energy-efficient investments, professionals can contribute to a greener future while achieving solid returns.

Investor Strategies: Aligning with Efficient Energy Solutions

Energy efficiency ratings have emerged as a crucial factor influencing investor strategies across various sectors. In today’s market, investors are increasingly aligning their portfolios with efficient energy solutions, recognizing both the environmental and financial benefits. This shift is driven by the growing awareness of climate change and regulatory pressures pushing for more sustainable practices. By examining energy efficiency ratings, investors can identify companies committed to reducing energy consumption and associated costs, which translates into improved financial performance.

A thorough analysis of energy efficiency ratings involves comparing key metrics across different enterprises. For instance, a study by the U.S. Department of Energy revealed that companies with superior energy management practices experienced an average 20% reduction in energy costs compared to their less efficient counterparts. This significant difference highlights the financial advantages of prioritizing energy efficiency. Investors can leverage these insights to make informed decisions, targeting companies with robust track records in energy efficiency ratings. For example, companies specializing in energy-efficient technologies, such as LED lighting or smart building systems, often attract investor interest due to their potential for sustained cost savings and market growth.

To maximize the benefits of aligning with efficient energy solutions, investors should adopt a strategic approach. This includes conducting comprehensive energy efficiency ratings comparisons, delving into company disclosures, and assessing long-term sustainability goals. By integrating these considerations into investment strategies, investors can not only contribute to environmental stewardship but also ensure their portfolios are positioned for success in the evolving market landscape. Staying ahead of trends, such as regulatory changes and consumer preferences for eco-friendly products, is essential for maintaining a competitive edge.

Case Studies: Successful Investments in Energy Efficiency

Energy efficiency ratings have emerged as a powerful tool, shaping investors’ strategies and driving significant financial trends. Successful investments in energy-efficient technologies demonstrate the tangible benefits of these ratings, offering both environmental and economic advantages. Case studies of notable investments highlight the strategic value of comparing energy efficiency ratings before committing capital. For instance, a leading renewable energy fund manager cited a 20% average return on investments in highly efficient LED lighting retrofits, surpassing their baseline expectations.

A deeper dive into these success stories reveals several key insights. First, companies with transparent and impressive energy efficiency ratings attract investor interest. Second, energy efficiency ratings comparison analyses play a pivotal role in identifying undervalued assets or overlooked markets. For example, a study comparing commercial building energy performance revealed that buildings with the highest efficiency ratings experienced 15% lower vacancy rates and 20% higher rental income. Lastly, these ratings enable long-term strategic planning, ensuring investments remain competitive and resilient against evolving regulations and consumer preferences.

Investors can leverage this knowledge by integrating energy efficiency ratings into their due diligence processes. Utilizing advanced analytics to benchmark performance across sectors provides a competitive edge. As the global transition towards sustainable energy continues apace, staying informed about energy efficiency trends will be crucial for navigating future financial landscapes. By embracing these strategies, investors not only contribute to environmental sustainability but also secure financially robust and forward-thinking portfolios.

Analyzing Return on Investment: Energy Efficiency's Impact

Energy efficiency ratings have become a crucial factor influencing investment strategies across various sectors, especially with growing environmental consciousness and regulatory changes. Investors are increasingly recognizing the financial benefits of energy-efficient technologies, which go beyond mere cost savings. By analyzing the return on investment (ROI) tied to energy efficiency ratings, investors can make informed decisions that drive sustainable growth.

A thorough examination of energy efficiency ratings comparison reveals significant advantages. For instance, a study comparing similar buildings with varying levels of energy efficiency found that those with higher ratings experienced an average 25% reduction in operational costs over a five-year period. This translates into improved cash flow and enhanced investment returns. Furthermore, many governments offer incentives such as tax credits or rebates for investments in energy-efficient infrastructure, providing additional financial momentum.

To maximize the impact of energy efficiency ratings on your investment portfolio, consider these actionable steps. Firstly, conduct a comprehensive assessment of your current assets’ energy performance using standardized rating systems. Secondly, set realistic targets for improvement based on industry benchmarks and best practices. Lastly, monitor and measure the results to demonstrate the tangible benefits of energy-efficient investments, ensuring ongoing ROI analysis and strategic adjustments. By integrating these strategies into your investment approach, you can not only mitigate risks but also capitalize on the growing market demand for sustainable solutions.

Future Prospects: Predicting Market Shifts via Ratings

Energy efficiency ratings have emerged as a powerful tool that significantly influences investment strategies across various sectors, particularly within the energy and technology industries. As the global focus on sustainability intensifies, these ratings are no longer mere niceties but critical indicators shaping market trends. Investors are increasingly leveraging energy efficiency ratings to predict and capitalize on emerging shifts in the energy landscape.

The future prospects of energy-efficient technologies are promising, as evidenced by rising investment in renewable energy sources and smart grid infrastructure. Companies with a proven track record of implementing energy-saving solutions often find themselves at the forefront of this transition. For instance, a detailed energy efficiency ratings comparison between traditional and advanced data centers reveals significant performance gaps, driving investors to prioritize green initiatives. This trend is expected to continue as regulatory bodies worldwide enforce stricter energy standards, pushing businesses to adapt and innovate.

By closely examining energy efficiency ratings, investors can identify early adopters of sustainable practices and potential disruptors in the market. For example, a startup specializing in smart home appliances with superior energy efficiency ratings could signal a significant shift towards residential energy conservation. This knowledge enables informed investment decisions, ensuring portfolios align with the evolving demand for energy-efficient solutions. As these ratings become more standardized and accessible, investors have a powerful resource to anticipate market shifts, foster sustainable growth, and potentially achieve substantial returns.