Energy efficiency ratings are vital metrics guiding borrowers' decisions across sectors, prioritizing sustainable choices. These ratings standardize comparisons, enabling cost savings through efficient energy conversion. Borrowers favor energy-efficient mortgages, attracting premium pricing for properties with high ratings. Regulatory standards and consumer interest drive this trend, fostering innovation in technology like LED lighting. Lenders assess energy performance, prompting borrowers to invest in efficiency solutions. Energy efficiency ratings transform borrowing landscapes, increasing asset value and contributing to global sustainability efforts. Future advancements will enhance rating accuracy and accessibility, promoting data-driven decisions for a greener future.

In today’s rapidly evolving economic landscape, energy efficiency ratings stand as a beacon guiding borrowers towards sustainable financial strategies. As global awareness of climate change intensifies, understanding how these ratings influence lending decisions becomes paramount for both institutions and individuals. This article delves into the intricate relationship between energy efficiency ratings and borrower strategies, exploring current trends that shape this dynamic field. By providing insightful analysis and practical implications, we aim to equip readers with the knowledge necessary to navigate this crucial aspect of modern finance effectively.

Understanding Energy Efficiency Ratings: The Basics

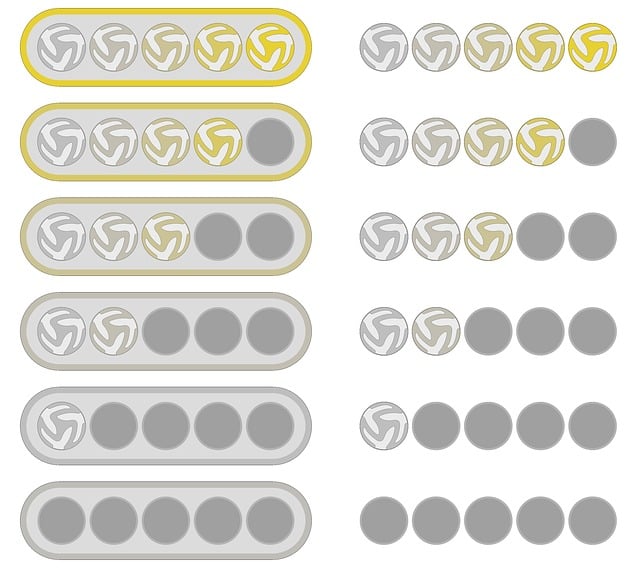

Energy efficiency ratings have become a critical factor in shaping borrowers’ strategies across various sectors today. These ratings serve as a powerful metric for evaluating the performance and cost-effectiveness of energy-related products and systems. By understanding and interpreting these ratings, borrowers can make informed decisions that drive sustainable growth and financial savings. At their core, energy efficiency ratings provide a standardized way to compare the energy consumption and performance of different appliances, buildings, or technologies.

The basic concept revolves around measuring how efficiently a product converts energy into useful output while minimizing waste. Ratings are often expressed as a numerical value or grade, indicating the level of energy performance compared to industry standards. For instance, in the context of home appliances, an Energy Star-rated refrigerator demonstrates superior energy efficiency when compared to non-rated or less efficient models. This simple yet powerful tool enables borrowers to assess and prioritize investments that offer significant long-term benefits.

When comparing different options, borrowers can leverage these ratings to identify opportunities for cost savings and environmental impact reduction. A thorough analysis involves examining multiple factors, including energy consumption patterns, operational costs, and the overall lifespan of the product or system. For example, in commercial buildings, an energy efficiency rating comparison between different HVAC systems can reveal a system with lower energy usage per square foot, leading to substantial utility bill reductions over time. By adopting a data-driven approach, borrowers can ensure that their strategies are not only financially prudent but also contribute to a more sustainable future.

Impact on Borrowers' Strategies: Trends Emerge

Energy efficiency ratings have emerged as a pivotal factor in shaping borrowers’ strategies, especially with the growing emphasis on sustainability and cost savings. As these ratings gain prominence, trends reveal a significant shift in how lenders and borrowers interact. The comparison of energy efficiency across properties has become a key differentiator in decision-making processes. For instance, studies show that borrowers are increasingly inclined to opt for energy-efficient mortgages, which offer lower interest rates and flexible terms, incentivizing both buyers and refinancers to invest in more sustainable homes.

This trend is further driven by the availability of comprehensive data on energy performance. Advanced tools enable lenders to conduct detailed energy efficiency ratings comparisons, allowing them to assess properties’ environmental impact objectively. As a result, borrowers with well-insulated homes or those featuring modern appliances and smart thermostats are likely to secure more favorable loan conditions. For example, a recent report indicated that properties with higher Energy Star ratings attract premium pricing, underscoring the market’s recognition of energy efficiency as a desirable feature.

Moreover, energy efficiency ratings impact not only individual borrowers but also influence broader market trends. Lenders’ adoption of standardized rating systems facilitates a level playing field, ensuring consistent evaluation methods. This standardization encourages borrowers to focus on long-term savings and reduces the reliance on short-term interest rate fluctuations. As these trends continue to evolve, borrowers are advised to stay informed about local energy efficiency programs and incentives, as they can offer substantial financial benefits over the life of a loan.

Key Factors Driving Energy Efficient Choices

In today’s market, energy efficiency ratings have emerged as a powerful tool for borrowers, shaping their strategic decisions with increasing prominence. The key factors driving these choices are multifaceted, reflecting both economic and environmental considerations. Borrowers are increasingly comparing energy efficiency ratings to make informed decisions about their investments, especially in the residential and commercial sectors. For instance, studies show that homes with higher Energy Star ratings attract buyers who are willing to pay a premium, underscoring the market value of energy-efficient features. This trend is not just a local phenomenon; globally, businesses are also demanding more energy-efficient solutions, pushing manufacturers and developers to prioritize these ratings in their products and projects.

One of the primary drivers behind this shift is the growing awareness of environmental sustainability. Borrowers, especially those from younger demographics, are increasingly conscious of their carbon footprint. Energy efficiency ratings provide a tangible way to measure and reduce energy consumption, contributing to broader sustainability goals. Moreover, regulatory bodies worldwide are implementing stricter energy standards, incentivizing borrowers to opt for energy-efficient options to avoid penalties or take advantage of government subsidies. For example, the European Union’s Ecodesign Directive sets stringent energy performance criteria for various products, influencing manufacturing practices and borrower preferences. This regulatory landscape encourages a competitive market where energy efficiency becomes a differentiator.

Comparing energy efficiency ratings has become an essential part of the borrowing process. Borrowers are now equipped with data that allows them to make apples-to-apples comparisons between different options. This transparency is fostering innovation, as companies strive to outperform each other in energy efficiency. As a result, consumers benefit from advanced technologies and designs that significantly reduce energy usage without compromising performance. For instance, LED lighting has become the go-to choice for many due to its superior energy efficiency compared to traditional incandescent bulbs, offering both cost savings and environmental benefits. In light of these trends, borrowers are not only shaping their strategies based on energy efficiency ratings but also driving industry-wide changes towards a more sustainable future.

Analyzing Market Shifts: Recent Developments

In recent years, the lending landscape has witnessed a significant shift as energy efficiency ratings have become an increasingly critical factor in borrowers’ strategies. This trend is driven by both regulatory pressures and consumer awareness of environmental sustainability. Lenders are now scrutinizing the energy performance of properties, prompting borrowers to prioritize energy-efficient solutions. For instance, a 2022 report by the U.S. Department of Energy revealed that improving energy efficiency in existing buildings could reduce energy consumption by up to 30%, offering substantial savings for both owners and lenders.

The market’s response to this shift is evident in the growing demand for energy-efficient financing options. Borrowers are actively seeking loans with lower interest rates tied to superior energy ratings. This trend is particularly notable in commercial real estate, where property managers aim to attract tenants conscious of environmental impact. An analysis by Deloitte shows that green buildings often command higher rental rates and experience faster tenant occupancy. As such, lenders are increasingly offering specialized products tailored to energy-efficient projects, fostering a competitive environment that incentivizes borrowers to enhance their properties’ ratings through comprehensive retrofits or new construction designs.

To stay competitive, borrowers must engage in an energy efficiency ratings comparison across similar properties. This analysis allows them to identify areas for improvement and set achievable goals. For example, a borrower considering a renovation might compare the proposed design’s expected energy performance with that of existing, similarly situated properties. By benchmarking against these standards, they can demonstrate to lenders their commitment to sustainability and potentially secure more favorable loan terms. Additionally, leveraging current market trends in favor of energy efficiency can enhance a borrower’s long-term asset value, ensuring a robust return on investment.

Future Projections: Shaping Sustainable Borrowing

In the evolving landscape of borrowing and lending, energy efficiency ratings have emerged as a powerful tool, guiding borrowers’ strategies towards more sustainable and cost-effective choices. As we look ahead, future projections indicate that these ratings will play an increasingly pivotal role in shaping the sustainability agenda within the borrowing sector. This evolution is driven by a growing awareness of environmental impacts and the urgent need to mitigate carbon footprints.

Borrowers today are increasingly comparing energy efficiency ratings as a key metric when assessing potential investments or loans. This comparative analysis allows them to make informed decisions, prioritizing projects or assets with superior energy efficiency. For instance, in the real estate sector, buyers may compare buildings’ energy performance certificates (EPCs) to identify properties with lower carbon emissions and higher energy savings. Such ratings provide a transparent benchmark, enabling borrowers to allocate resources more efficiently while aligning with sustainability goals. As regulatory pressures mount for reduced environmental impact, lenders are expected to incorporate these ratings into their risk assessment frameworks, potentially influencing interest rates and loan terms.

Looking ahead, the future of borrowing is poised to be even more deeply intertwined with energy efficiency ratings. Advancements in technology will enhance rating accuracy and accessibility, empowering borrowers to make data-driven choices. Improved energy modeling tools and standardized rating systems will facilitate a fairer comparison across various sectors. Moreover, as green financing gains traction, lenders may offer incentives or preferential rates for borrowers who demonstrate strong energy efficiency performance. This shift encourages a more responsible approach to borrowing, where sustainability is not just a consideration but a fundamental driver in strategic decision-making. By embracing these trends, the borrowing community can contribute significantly to global efforts towards a greener and more resilient future.